About Paul B Insurance

Table of ContentsThe Ultimate Guide To Paul B InsuranceFascination About Paul B InsuranceRumored Buzz on Paul B Insurance7 Easy Facts About Paul B Insurance ExplainedThe Paul B Insurance Diaries

Today, house proprietors, cars and truck owners, organizations as well as organizations have available to them a large range of insurance products, numerous of which have actually become a requirement for the performance of a free-enterprise economic climate. Our culture could hardly work without insurance. There would certainly a lot unpredictability, a lot direct exposure to sudden, unforeseen possibly catastrophic loss, that it would certainly be hard for anybody to intend with self-confidence for the future.The larger the variety of premium payers, the much more accurately insurance firms are able to estimate potential losses hence determine the quantity of premium to be collected from each. Due to the fact that loss occurrence may alter, insurance companies remain in a continuous process of collecting loss "experience" as a basis for periodic evaluations of premium needs.

In this respect, insurers execute a resources development feature comparable to that of banks. Therefore, business enterprises obtain a dual benefit from insurancethey are made it possible for to run by transferring potentially crippling risk, and also they also may get resources funds from insurance providers through the sale of stocks and bonds, for instance, in which insurance firms invest funds.

For much more on the insurance market's payments to society and the economy see A Firm Structure: How Insurance Policy Supports the Economic Climate.

Not known Details About Paul B Insurance

Being mindful of what's readily available as well as just how it works can have a major influence on the price you will pay to be covered. Equipped with this understanding, you'll be able to choose the best plans that will certainly shield your way of living, possessions, and also home.

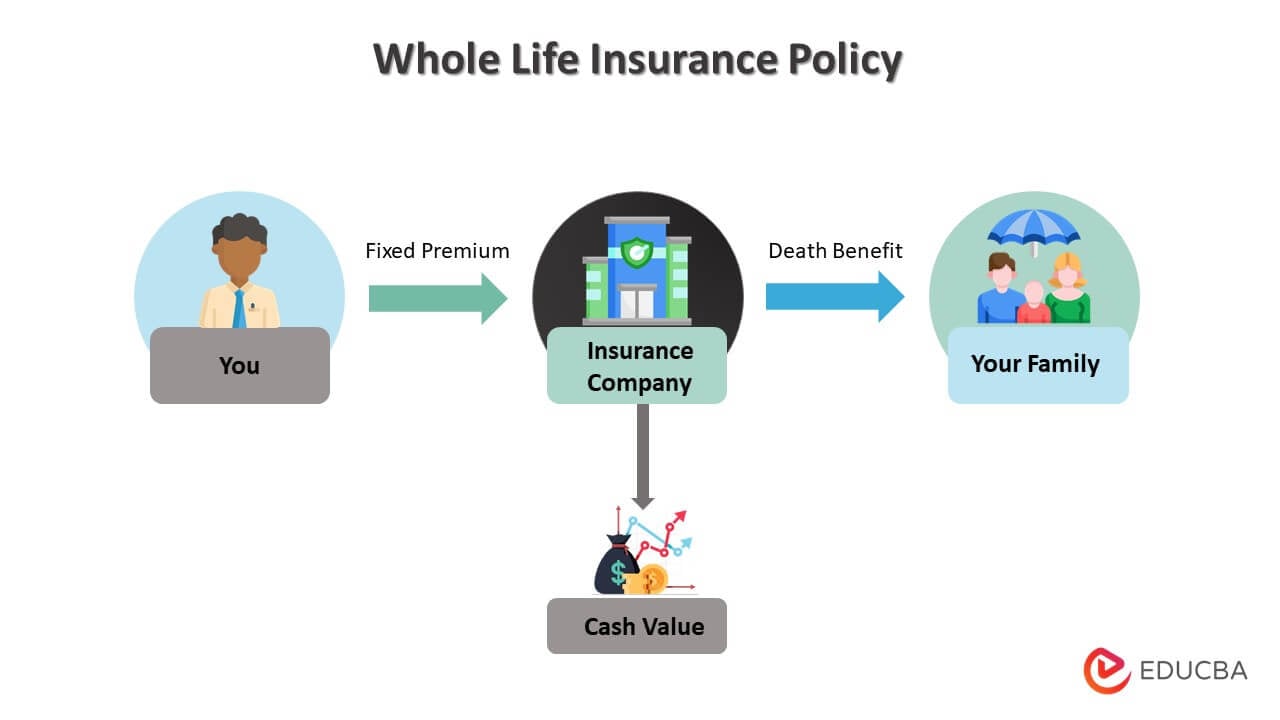

When you have something to shed, and also you can't manage to pay for a loss yourself, you spend for insurance coverage. By paying cash every month for it, you obtain the tranquility of mind that if something fails, the insurance coverage business will certainly spend for things you need to make life like it was before your loss.

The insurer has lots of customers. They all pay premiums. Not every client will certainly have a loss at the exact same time. When a loss happens, they may get insurance cash to spend for the loss. Everyone does not have to acquire it, yet it is a great suggestion to acquire insurance when you have a great deal of financial danger or financial investments on the line.

Some insurance coverage is added, while various other insurance, like automobile, may have minimum needs set out by law. Some insurance coverage is not called for by law. Lenders, banks, as well as home loan firms will require it if you have borrowed cash from them to purchase worth a great deal of cash, such as a home or a cars and truck.

Getting My Paul B Insurance To Work

You will need vehicle insurance coverage if you have a vehicle loan and home insurance if you have a home car loan. It is often required to get a finance for large purchases like homes. Lenders wish to make certain that you are covered versus risks that might trigger the worth of the vehicle or residence to decrease if you were to experience a loss before you have actually paid it off.

Lending institution insurance is more expensive than the policy you would certainly get on your own. Some companies may have discounts geared at bringing in certain kinds of customers.

Various other insurance companies might create programs that offer larger discounts to elders or members of the armed force. There is no other way to understand without looking around, contrasting policies, and obtaining quotes. There are 3 primary reasons that you must acquire it: It is called for by law, such as responsibility insurance for your automobile.

A monetary loss might be past what you could manage to pay or recoup from conveniently. For example, if you have costly computer tools in your home, you will intend to purchase tenants insurance policy. When most people assume about individual insurance policy, they are likely thinking concerning among these five major types, to name a few: Residential, such as home, condominium or co-op, or tenants insurance.

Our Paul B Insurance PDFs

Watercraft insurance policy, which can be covered under home insurance policy in some conditions, and also stand-alone watercraft insurance for vessels of a particular rate or size that are not covered under house insurance. Medical insurance and life and disability insurance policy. Responsibility insurance coverage, which can fall under any of these groups. It covers you from being sued if another person has a loss that this post is your fault.

Insurance needs licensing and is separated into teams. This suggests that before someone is lawfully permitted to sell it or offer you with advice, they have to be accredited by the state to market as well as offer recommendations on the type you are buying. As an example, your residence insurance broker or representative may inform you that they do not supply life or disability insurance coverage.

If you're able to purchase more than one kind of policy from the exact same person, you might be able to "pack" your insurance policy and also get a discount for doing so. This includes your major residence along with any kind of other structures in the area. You can locate standard health and wellness benefits along with other health policies like oral or lasting care.

Some Of Paul B Insurance

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

If you obtain a really affordable price on a quote, you need to ask what sort of plan you have or what the limits of it are. Compare these details to those in various other quotes you have. Plans all have certain areas that note limitations of amounts payable. This puts on all sort of plans from health to vehicle.

Inquire about what coverages are limited and also what the restrictions are. You can frequently request the type of plan that will certainly use you higher limitations if the limits revealed in the plan issue you. Some kinds of insurance have waiting durations prior to you will be covered. As an example, with dental, anonymous you might have a waiting duration.